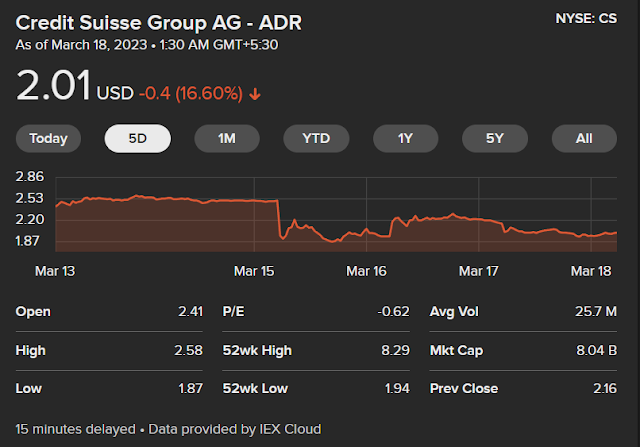

On March 15, credit Suisse shed a quarter of its value after its largest shareholder said it could not provide any more support. Saudi national Bank(SNB) who is the largest shareholder which hold about 9.9% credit Swiss, said it would not buy any more shares. According to the statement of SNB chairman Ammar Al Khudairy "we cannot because we would go above 10 per cent. Its a regulatory issue". After that the shares of credit Swiss dropped by as much as 30%, which leads to a fall of 7% in the European banking index. The stick has pummelled earlier in the week due to the collapse of US tech lender silicon valley Bank. The analysts of France said that the credit Suisse want a bailout by the Swiss National Bank and financial regulator FINMA, possibly one or more other banks. The analysts also said that the Saudi National Bank could do a U-turn.. Last year the Saudi National Bank has increased it stake in credit Suisse and committed to invest up to $1.5 dollars. On Tuesday the bank published its

to the statement of SNB chairman Ammar Al Khudairy "we cannot because we would go above 10 per cent. Its a regulatory issue". After that the shares of credit Swiss dropped by as much as 30%, which leads to a fall of 7% in the European banking index. The stick has pummelled earlier in the week due to the collapse of US tech lender silicon valley Bank. The analysts of France said that the credit Suisse want a bailout by the Swiss National Bank and financial regulator FINMA, possibly one or more other banks. The analysts also said that the Saudi National Bank could do a U-turn.. Last year the Saudi National Bank has increased it stake in credit Suisse and committed to invest up to $1.5 dollars. On Tuesday the bank published its annual report for 2022, it identifies "material weaknesses" in control over financial reporting and not yet stemmed customer outflows. credit Suisse which is the second largest bank of Switzerland is seeking to recover from a string of scandals that here undermined the confidence of investors and clients.

annual report for 2022, it identifies "material weaknesses" in control over financial reporting and not yet stemmed customer outflows. credit Suisse which is the second largest bank of Switzerland is seeking to recover from a string of scandals that here undermined the confidence of investors and clients.

However, in the statement early Thursday, Credit Suisse officials said "it is exercising its option to borrow " from the Swiss National bank which is around $54 billion. Note that is is going to be the first major global to be given an emergency lifeline since 2008 global meltdown.

Founded in 1856, Credit Suisse has faced many scandals in recent years and in its past too, which includes Money Laundering charges. In the last two years, it has reportedly lost money and has issued a warning of staying in the red till 2024. This new crisis could mean a longer road towards profitability, or even solvency. The traders

expected that the US federal reserve, which was expected to hike interest rates last fortnight due to inflation, may be forced to hit a pause and even to give cut in interest rates. The crisis had triggered concerns about the health of Europe's financial system and a contagion effect.

Established in 1997, Credit Suisse has offices in Mumbai-Pune and Gurgaon, with Vendor offices in Bangalore, Hyderabad and Kolkata. Credit Suisse, as per reports "has less than Rs 20,000 crore" in assets(12th among foreign Banks), presence in the derivatives market and founded 60% of assets from borrowing, of which 96% are up to two months, but still Credit Suisse more relevant to India's financial system than the Silicon Valley Bank. But still as per sources, RBI is keeping a close tab on the evolving situation caused due to shuttering of a few banks and stress in other global lenders.

really helpful

ReplyDelete