Building export market takes effort. Overseas buyers need to be convinced about the price competitiveness, product quality, and the reliability of supplies from the exporting country. March 31, 2023, India's sugar export can cross5.5 billion i.e. which is about 45,000 crore. For this sugar season(October 2022 to September 2023), the

|

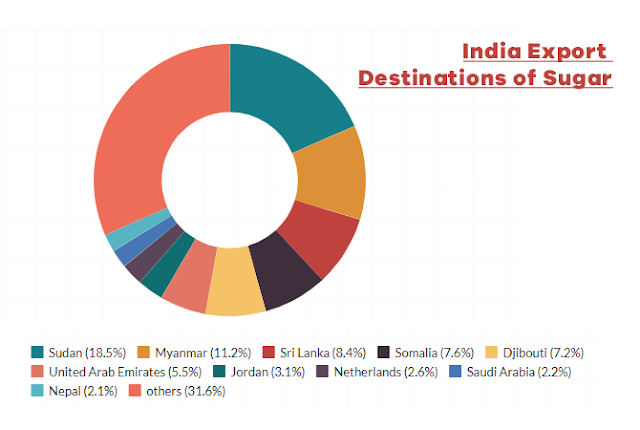

| According to data of 2021 |

Types of Grades of sugar

Raw Sugar: it is what mills produce after the first crystallization of juice obtained from crushing the cane. This sugar is rough and brownish in color, with a ICUMSA(International Commission for Uniform Methods of Sugar Analysis) value of 600-1200 of higher, ICUMSA is the measure of the purity of sugar based on color. The lower the value, the more the whiteness. Much of the world's sugar trade is in 'raw' and they can be transported in bulk vessels. This is because the raw sugar requires no bagging or containerization and can be loaded in bulk. The buyer of raw sugar is the refiner, not the end-consumer.

Refined Sugar: Raw sugar is then processed in refineries for removal of impurities and de-colourization. The end product is refined white cane sugar having a standard ICUMSA value of 45. The sugar used by industries such as pharmaceuticals has ICUMSA of less than 20.

What are the advantages of Indian Raw Sugar?

Around mid-2018, a team of officials led by the joint secretary(sugar) in the Ministry of consumer Affairs, Food and Public Distribution, Suresh Kumar Vashisth, and industry representatives visited Indonesia, Malaysia, South Korea, China and Bangladesh.

1. The time window of Indian Production: The refineries in Indonesia, Malaysia, South Korea, China and Bangladesh import raw sugar from Brazil. Brazilian mills operate from April to November, whereas India's crushing is from October to April. Hence, they are utilizing Indian raw sugar during Brazil's off-season.

2. Freight Cost saving: The voyage time from Kandla, Mundra or JNPT to Ciwandan Port of Indonesia is 13-15 days, compared to 43-45 days from Brazil's port of Santo's.

Apart from the time window and freight cost savings, the delegation highlighted two specific advantages of Indian raw sugar.

Dextran: It is a bacterial compound formed when sugarcane stays in the sun too long after harvesting. "Our raw sugar has no dextran , as it is produced from fresh cane crushed within 12-24 hours of harvesting. The cut-to-crush time is 48 hours or more in Brazil. "the officials said.

India can supply raw sugar with high polarization :Polarization is the percentage of sucrose present in a raw sugar mass. Indian mills could provide raws with high polarization 98.5-99.5%. The more the polarization- it is only 96-98.5% in raws from Brazil, Thailand and Australia- the easier and cheaper it is to refine.

"We created awareness about the quality of Indian raw sugar. So much so that our raws today fetch a 4% premium over the global benchmark price. This is in contrast to white sugar. There, our so-called LQW sells at a $40/tonne discount to the world price for 45 ICUMSA whites," the officials noted. The efforts to push exports of raws got a further boost when Indonesia, in December 2019, agreed to tweak its ICUMSA norms to enable imports from India. The Southeast Asian Nation previously imported only raw sugar of 1,200 ICUMSA or more, largely from Thailand. Those levels were brought down to 600-1,200 to allow its refiners to process higher purity raws from India.

The Outcome

Out of India's total 110 lt sugar exports in 2021-22, raws alone accounted for 56.29lt. The biggest importer of Indian raw sugar were Indonesia(16.73lt), Bangladesh(12.10lt), Saudi Arabia(6.83lt),

|

| According to 2020 data |

like it❣️

ReplyDelete